On Tuesday this week, Ministers Wong and Conroy released the eagerly awaited DFAT International Development Policy on behalf of the Australian Government.

DFAT’s Development Finance Review, which underpins the new policy, was also launched. The Development Finance Review is the outcome of DFAT’s call for submissions from the Australian development ecosystem in September 2022 and considers new forms of development finance to support Australia’s foreign policy, trade, security, and development objectives.

Critically, the Review also responds to the fact that there is currently a development financing gap of US$4.2 trillion globally required to achieve the Sustainable Development Goals by 2030 (ACFID 2022). Meeting this gap will require collaboration between the entire international development ecosystem – from local partners, participants, and NGOs, to policy makers and financial institutions.

ACFID’s Director of Policy and Advocacy, Jessica Mackenzie, and Good Return CEO, Shane Nichols previously called for Australia to enhance its current development financing mechanisms and capabilities (ACFID 2022).In this context, the Development Finance Review has also been eagerly anticipated.

What is clear from the Review is that a focus on blended and climate finance will be a key strategy moving forward. To be sure, “blended finance” has increasingly appeared in global development policy circles, reports, and discourse over the last decade. However, as “blending” is still an evolving development finance strategy, there is continued confusion around implementation and strategy, stakeholder participation or data sources (Oxfam, 2017).

What is blended finance?

In this context, is it timely to clarify: what actually is blended finance? What does it look like in practice? And what can it do for urgent international development outcomes? In response to these questions, we’ve called upon Shane Nichols to break down “blended finance”, drawing on his own experience as Good Return’s CEO and managing Good Return’s Impact Investment Program.

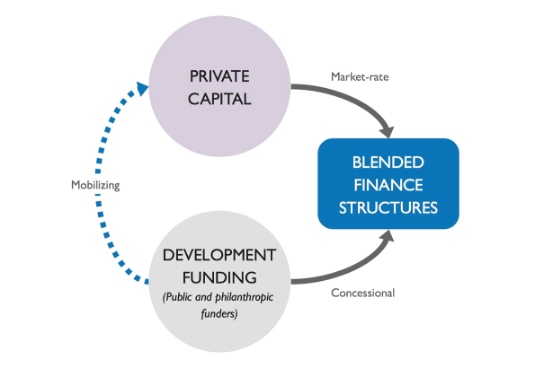

By definition, blended finance is the “the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development”. To put this in clearer terms, blended finance is the strategy whereby public funds are raised to de-risk or ‘leverage’ private investments into development programs or projects that private finance may otherwise deem risky (Development Initiatives 2016). In particular, blended finance strives to attract commercial capital towards projects and programs that strive to contribute to sustainable development, while concurrently providing financial returns to investors (OECD, 2023).

Overall, this innovative approach helps enlarge the total amount of financial resources available to developing countries complementing their own investments and Official Development Assistance (ODA) inflows (OECD, 2023). Crucially, it has been argued that this strategy may therefore contribute to the wider, global commitment to funding the Sustainable Development Goals (SDGs).

Addressing a critical financing gap for small businesses

One example of “blending” is Good Return’s Impact Investment Fund. Good Return’s Impact Investment Fund was established to address a critical financing gap for small and growing businesses in the Asia Pacific region. The Fund currently focuses on making agricultural value chains more inclusive in Cambodia and Indonesia, and identifies and supports small to medium sized businesses that play a vital role in bringing jobs and income to people living in poverty, especially women.

To do this, Good Return’s $1 million Impact Investment Fund acts as a guarantee for loans. The funding model utilises Good Return’s unique position as both a DGR1 entity (able to accept tax deductible donations) and as holder of an Australian Financial Services License to mobilise blended capital and achieve leverage. Crucially, the first-loss component of the Fund was provided by DFAT under the Frontier Brokers program. This blending of finance served to ‘de-risk’ and ensure a cash deposit rate of return on the investment for private Australian investors looking to make an impact in emerging markets.

Using this funding leverage model, the catalytic fund provides loan guarantees to Good Return’s in-country partner financial institutions, including Chamroeun in Cambodia and CROWDE in Indonesia, to incentivise them to lend to underserved market segments that create jobs and income for people living in the poverty, with a focus on women.

In addition to the loan guarantee function of the Impact Investment Fund, the Good Return Impact Investment Capacity Building Fund is a secondary, related grant fund that pays for training and technical assistance activities with the partners. This ensures holistic and sustainable investing – whereby the partners on-the-ground receive appropriate support and training to build their business and maximise impact in their region.

So far, this blended model has leveraged $4.73 million in loans to 470 SMEs in Indonesia and Cambodia. These investments have supported jobs and income for 3,963 people. Moreover, 96% of the loan recipients were women.

Learn more here: https://goodreturn.org.au/impact-investing

Leave a comment