I have always believed that if you provide the appropriate incentives, investment markets are the most efficient mechanism to drive behaviour change. But when it comes to the restoration and protection of nature, the market currently has some seriously counter intuitive incentives in place, and those incentives are creating a moment in time to generate an attractive investment return for investors.

Carbon credits have emerged as the most pragmatic way to incentivise the better management of land and nature. They provide an attractive economic incentive to improve the environment, where there was none before. They have robust validation processes, which are constantly improving over time to increase the integrity of the market and they are not difficult to access.

Looking at the issue of deforestation in Australia, our Government, through the Clean Energy Regulator, has attempted to tackle this issue through carbon markets and Australian Carbon Credit Units (ACCU). The Avoided Deforestation methodology was one of the first methodologies (the rule books that define how carbon credits are produced) created by the Clean Energy Regulator. Historically, 20% of ACCUs have been generated from this methodology. This methodology essentially paid farmers to not clear the trees from their land, where they had permits to do so.

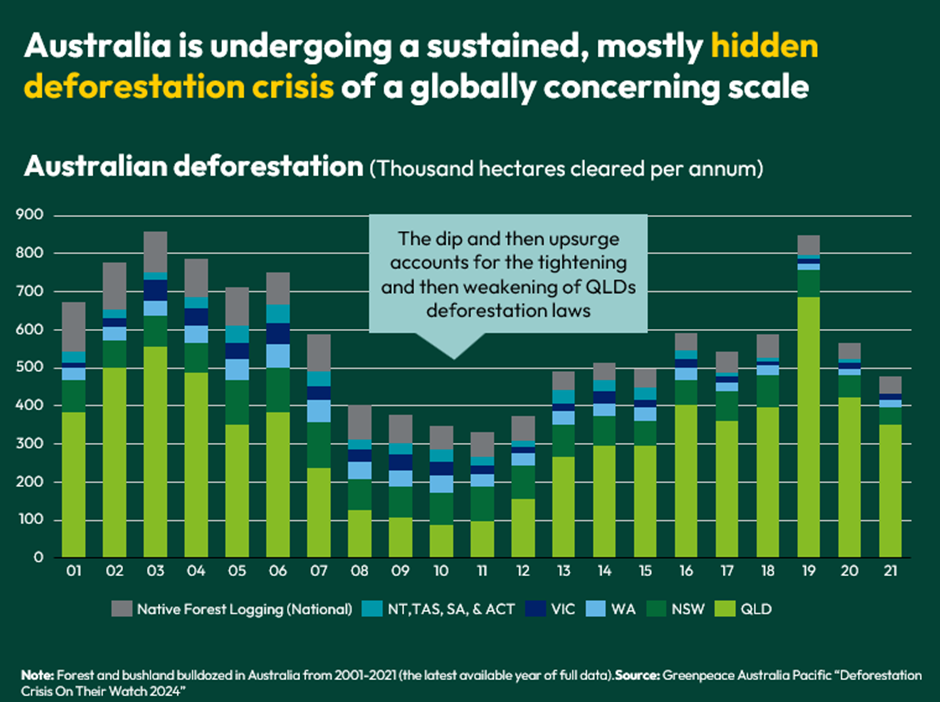

Despite all the criticism that the Avoided Deforestation methodology received (including from myself), we clearly have a deforestation problem in Australia. In the last five years, over three million hectares of land has been cleared for agriculture in Australia, which is roughly the size of Belgium.

This seems crazy for several reasons. Firstly, agricultural yields have improved significantly, due to technological advancements, better farming practices, and advances in irrigation technologies. So, theoretically, we should be able to use less land to achieve the same if not more agricultural output. Secondly, Australia is a developed country. Historically, developed countries have already cleared significant amounts of land for agriculture during earlier stages of their development. As a result, they have established agricultural lands that can be optimised for productivity rather than expanding into new areas.

Whilst the Avoided Deforestation methodology has been used to generate a significant amount of ACCUs, the methodology was recently revoked in 2023, and has not been replaced with a new one, primarily due to questions around additionality and assumptions regarding land clearing rates.

For a carbon credit to be valid, first and foremost it must be additional. That is, the project would not have taken place if it were not for the revenue generated from the carbon credit. Additionality refers to the principle that the emission reductions or carbon sequestration resulting from a project are additional to what would have occurred in the absence of the project. In the case of Avoided Deforestation, if the farmer was not paid (via carbon credits) to not clear their land, there is a high probability the farmer would have cleared their land. This is where my scepticism came into play. As with other avoidance methodologies, additionality is hard to calculate when it is a counterfactual scenario. We will never know if the farmer was actually going to clear their land, however typically the methodology will extrapolate the expected likelihood from historical clearing rates.

With the Avoided Deforestation methodology gone, we now have two problems in the market.

Firstly, in the absence of regulation or environmental law, there is no economic incentive in place for a farmer to leave their trees in the ground. From a farmers perspective, they can increase their output by clearing their land, making more room for more head of cattle.

Secondly, at the same time that we are clearing huge swathes of land, groups like Kakariki Capital are replanting other previously cleared land in order to generate carbon credits which are in high demand from corporates looking to compensate their emissions. From a pure economic stand point, this is crazy. While it might cost up to $500/ha to clear land, it can cost up to $8,000/ha to replant the trees. This is a huge market inefficiency, and one that creates an attractive investment opportunity.

Putting the economic argument to one side, preventing deforestation is also better from a biodiversity perspective. Tens of millions of native animals, including koalas, are killed each year due to habitat loss, and while we can replant native trees, it is almost impossible to bring back the same level of biodiversity. Lastly, we also don’t have access to enough native seedlings to replant at the rate needed to meet demand. We need to do both, stop the deforestation and restore previously cleared land. The deforestation is causing harm to land, polluting rivers, contributing to climate change, and damaging the Great Barrier Reef.

We all need to eat. Agriculture is a vital part of Australia’s economy, but we have already cleared an overabundance of land in Australia, I am waiting for someone to show me the hard evidence as to why we need to clear more. If you believe there is a need to clear more agricultural land, it is important to note that farmers benefit more from selectively clearing land, leaving shelter belts, wind breaks and similar features. However, unfortunately, it is more cost-effective to clear an entire area using two bulldozers and a chain, than to selectively remove trees. We need economic incentives (i.e. carbon credits) in place so farmers stop mass land clearing, and only use the best agricultural land for agricultural farming.

We need to restore previously cleared land AND stop more land from being cleared. To achieve this, we need economic incentives. Carbon markets are the most effective tools to do this. Most companies today are on the path to net-zero, but they all have emissions that they currently cannot directly eliminate. They are willing and able to pay landholders to preserve existing trees, and plant new trees on land that has been cleared.

The longer we fail to stop deforestation, the larger the opportunity to generate returns from planting native species. It is inefficient, but that is where investment returns are made. At Kakariki, our Land Generation Fund purchases agricultural land and optimise it for its highest and best use (whether that be carbon or agriculture). We acquire previously cleared land and plant native trees on agriculturally unsuitable areas, generating carbon credits, optimising land value, and delivering attractive returns for investors while positively impacting the environment.

Kakariki Capital are on a mission to decarbonise the planet and deliver exceptional returns for our investors. For more see www.kakarikicapital.com.