The overall financial position of the residential care sector improved during 2022-23, a new report shows.

Released this month by the Department of Health and Aged Care, the Financial Report on the Australian Aged Care Sector shows the percentage of profitable residential care providers rose during the period by 12% to reach 43% of the sector.

Financial data submitted by providers through the Aged Care Financial Report is used to produce FRAACS – the annual report of the aged care sector’s financial performance.

Department number crunchers found revenue rose in 2022-23 by $527 million – up 23% from 2021-22. But as the report’s authors note: “While this is an improvement on the sector financial position, the residential aged care sector is still operating at a loss.”

They add: “Increased revenue through the introduction of the Australian National Aged Care Classification funding model from 1 October 2022, and the increased realisation of Covid-19 grants revenue, were key drivers in the improved result.”

Although an improved result, on a per resident ratio, the loss equates to $25.31 a day.

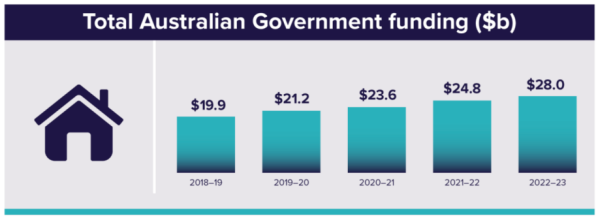

The report shows total government funding for the period up on the previous year by just more than $3 billion – $28 billion.

The majority of government expenditure funded residential care (57.5%). Home care came next (20%), then home support (13.2%), flexible aged care (3.2%), and other aged care (6.1%).

Employee expenses in the residential care sector were at $16.8 billion in 2022-23 – up from $15.9 billion the previous year. “The increase is likely attributed to increased spending on care labour by providers working towards their mandatory care minute targets, which came into effect on 1 October 2023,” say the report’s authors.

“In addition, providers may also have been spending more money on care labour in preparation for the 24/7 registered nurse care requirement, which came into effect on 1 July 2023.”

Employee expenses are expected to increase again in 2023-24 with the introduction of the Fair Work Commission’s interim decision to raise minimum award wages for RNs, enrolled nurses and personal care workers by 15% from 30 June 2023.

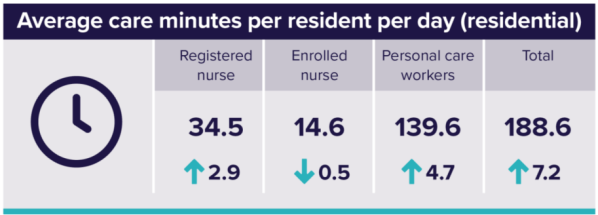

Crunching care minutes, the report shows residents receiving a total average of 188 care minutes per day – up seven minutes on 2021-22 but below the yet-to-be-mandated 200-minute target.

Similarly the average registered nurse threshold of 40 minutes per resident a day also missed the incoming mark with the department recording 34.5 minutes during the period but still up slightly on 2021-22 by almost three minutes (2.9).

Home care

When analysing home care sector stats, the report’s authors found the percentage of profitable providers stayed more or less the same at 68% – down 1% on the previous year and down 6% in 2020-21.

“In 2022-23 sector profitability was impacted because the increase in revenue ($1.71 per client a day) was not proportionate to the increase in expenses ($2.31 per client a day,” say the report’s authors. “Increases in administration and support expenses may also be impacting profits,” they add.

Government expenditure on the Home Care Packages program increased during the period – up from $4.4 billion in 2021-22 to $5.6 billion in 2022-23. “This has led to a 20% increase in the number of people accessing home care packages,” say the report’s authors, “– up 42,631 recipients from 2021-22.”

Government funding for the Commonwealth Home Support Program also increased from $2.9 billion in 2021-22 to $3 billion in 2022-23. Although funding increased, the authors note the number of CHSP clients declined to 816,132 in 2022-23, down from 818,228 the previous year.

With more older Australians able to access home care, residential care use has declined across all age groups for the past two decades. However, the projected demand for residential care is expected to double over the next 20 years as the country’s ageing population grows.

The department will continue to expand its analysis and monitoring of the sector so that data can be shared with providers and other stakeholders, say the report’s authors. “This will ensure aged care providers are able to use up-to-date analysis on the current and potential future state of the aged care market to inform business and investment decisions.”

This story first appeared on Australian Ageing Agenda.

For more on the Aged Care sector, follow Australian Ageing Agenda on LinkedIn, X (Twitter) and Facebook, sign up to its twice-weekly newsletter.