The growing imperative to understand ESG risks in supply chains

Good supply chain management has always been a key component of growing successful businesses. Negative impacts from poor supply chain management include operational disruption, increased costs and reputational damage. However, it is notoriously complex, often spanning multiple tiers and countries, with high degrees of opaqueness.

A number of recent developments suggest a trend towards ever increasing standards for responsible business conduct in terms of transparency, understanding and management of supply chain risks. Companies are now being pushed to consider ESG risks and opportunities not just in their own operations, but also in their supply chains. However, this goes beyond just risk mitigation – by working with their suppliers on sustainability improvements companies can unlock a range of value creation opportunities.

“Companies will have to avoid and address harm done to people and planet in their supply chains”1.

These words reflect a new reality for businesses, in an age where customers and employees have both greater access to information and higher ethical expectations of the organisations who provide their products and services and employ them. Large brands like Apple and Dell have been embarrassed by human rights and environmental failings in their immediate supply chains. Even unsuccessful public lawsuits – like the recent US legal action launched by former child slaves from Mali against Nestle and other large chocolate companies – can have devastating reputational effects in the court of public opinion.

Europe is setting the pace. In March 20212 the EU Parliament sent a strong signal when an overwhelming majority voted in favour of a legislative initiative for an EU directive requiring businesses operating in the EU to conduct due diligence on human rights, the environment and governance across their supply chains3. Since then, in June 2021, Germany also passed a Supply Chain Law4 to gradually introduce mandatory human rights and environmental due diligence for German companies (including foreign companies with registered branches in Germany) from 1 January 2023.

Closer to home, on 23 August 2021, the Australian Senate passed the Customs Amendment (Banning Goods Produced By Forced Labour) Bill 2021, which will amend the Customs Act 1901 to prohibit the importation into Australia of goods that are produced in whole or in part by forced labour. It is unclear at this time if the lower house will support the introduction of this legislation.

What does this mean for businesses?

“it is more critical than ever that businesses in the 21st century are focused on generating long-term value for all stakeholders and addressing the challenges we face, which will result in shared prosperity and sustainability for both business and society” 5

This increasing scrutiny and the introduction of regulatory standards will have a significant impact on business operations:

- Management and Boards will need to understand the broader global context of supply chains in order to manage risks and create value.

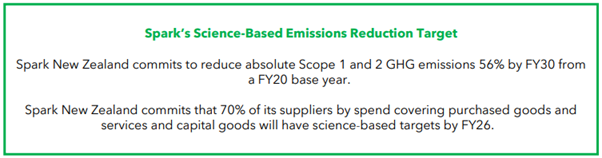

- Robust supply chain sustainability due diligence processes will be critical, covering issues as wide-ranging as employee conditions, impact on local communities, greenhouse gas emissions management and environmental controls. A good example of this is Spark NZ’s (held in Melior portfolio) recent commitment that 70% of its suppliers by spend6 will have science-based emissions reduction targets by FY26.

- Management teams will need to allocate resources to map and actively engage with tier 1 suppliers and beyond, and invest in supporting systems and tools as part of their broader risk management framework.

- Training and education will be fundamental to the proper assessment and management of these new kinds of risks – from the workforce all the way up to the Board.

Although this will intensify for businesses with supply chains in jurisdictions with high risks of forced labour practices or low levels of environmental regulation, it is relevant for all businesses because no country – including Australia – is immune from the risks of causing harm to people or the planet.

Evidence suggests that companies still have a long way to go – for example, the Australian Council of Superannuation Investors’ recent report into ASX200 reporting under the Modern Slavery Act7 identified a number of opportunities for improvement after the first round of corporate reporting. Businesses that prioritise these initiatives will not only protect against business continuity and reputational risks, but will build stronger supplier partnerships with more opportunities for long-term growth and innovation and win a growing segment of consumers who factor sustainability into their decision-making.

The Melior response

“Sustainable Development Goal 10: Reduce inequality within and among countries”8

Advocacy – Reduced Inequalities is one of Melior’s Key Strategic Advocacy Themes with which we are engaging with Corporate Australia. We also track our discussions with companies in this area. Progress towards SDG 10 is currently rated as facing “significant challenges” on both Australia and New Zealand’s SDG dashboards9. We believe better identification and management of modern slavery risks within operations and supply chains can contribute to achieving SDG 10.

We see increasing risk that stakeholders, including regulators, will not allow embedded supply chain emissions to be carved out of a company’s carbon footprint when considering necessary climate action. This is why we published our views on the pressing need for action on Scope 3 emissions and contributed to the development of carbon risk management tool Emmi10 which provides a comprehensive financial perspective on carbon risk.

Nina Wilkinson is portfolio manager at Melior

Natasha Morris is Director of Responsible Investing at Adamantem Capital

Melior Investment Management is a Sydney based impact investment manager that’s committed to driving positive change through investing in high-performing public market companies.

Sources

- Lara Wolters, the Dutch MEP who acted as rapporteur in relation to the European Parliament resolution of March 2021

- https://www.europarl.europa.eu/doceo/document/TA-9-2021-0073_EN.html#title1

- This requires further action by the European Commission to now put forward a formal Proposal, which will become effective once adopted by the Parliament and the Council (representing the 27 member states)

- https://dserver.bundestag.de/btd/19/305/1930505.pdf

- Darren Walker, President of the Ford Foundation, in response to the US Business Roundtable Statement on the Purpose of a Corporation, August 2019

- https://investors.sparknz.co.nz/FormBuilder/_Resource/_module/gXbeer80tkeL4nEaF-kwFA/FY21%20Results%20Summary%20FINAL.pdf

- https://acsi.org.au/wp-content/uploads/2021/07/ACSI_ModernSlavery_July2021.pdf

- https://sdgs.un.org/goals/goal10

- https://dashboards.sdgindex.org/profiles/australia

- www.emmi.io

https://www.globalslaveryindex.org/2018/findings/global-findings