It’s officially called the ‘Inflation Reduction Act’, and it involves $US370 billion in spending (which seems inflationary, but we won’t let that get in the way).

With the bulk of the spending focussed on clean energy and climate change mitigation, it’s being called the ‘US Climate Bill’, and it’s being viewed as a monumental achievement.

It’s “by far, the biggest climate action in human history” says Democratic Senator Brian Schatz.

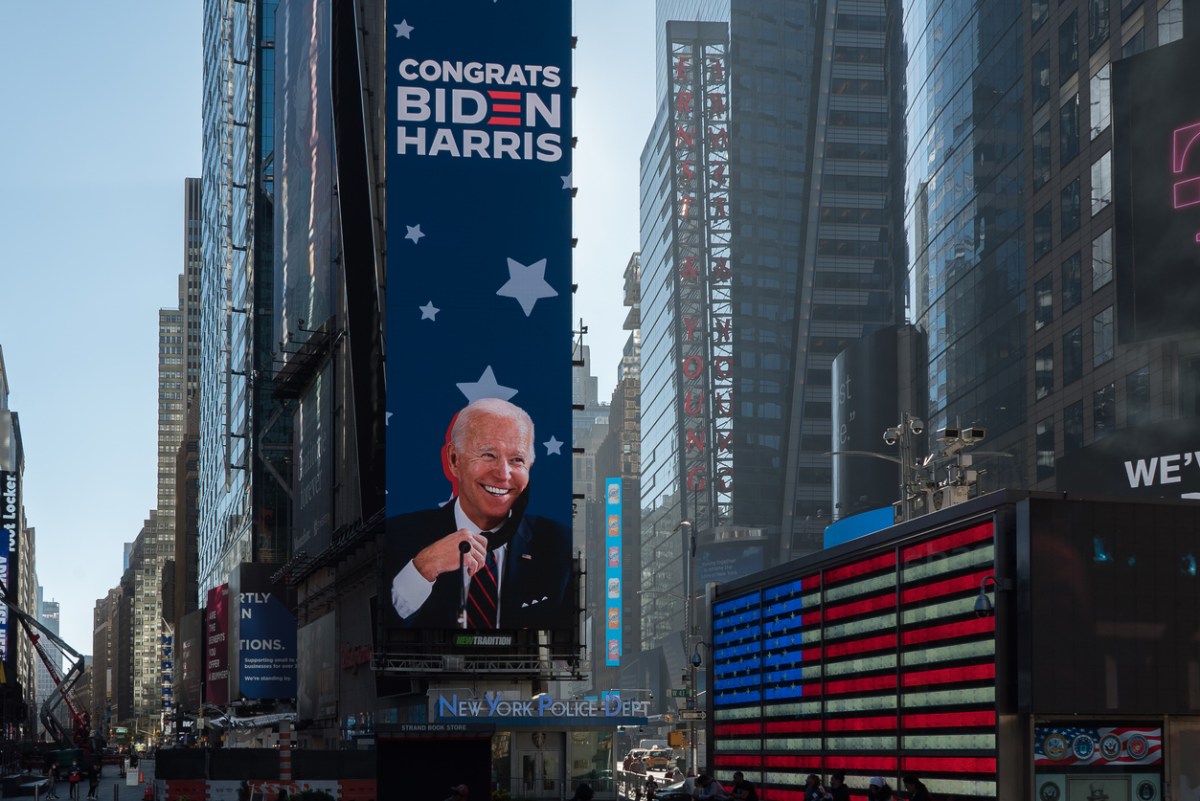

It marks a profound shift on the pathway to a decarbonized economy, and will go a long way to push the US towards President Biden’s goal of halving US emissions by 2030. Independent assessments suggest this Bill could see US emissions cut by 40%.

It comes at a time when the oil and gas industry is making record profits off the back of the war in Ukraine, and spiraling inflation. And questions remain about whether support for clean energy is enough, as rules to limit emissions are conspicuously absent.

As is to be expected, there was determined opposition from Republican Senators and Congress, and even on the Democrat side they required careful negotiation as Joe Manchin, West Virginia Senator, flip-flopped on supporting the bill. He eventually complied after compromises relating to fossil fuel rights (noting he receives more political donations from the fossil fuel industry than any other Senator).

“In crossing this threshold we have changed history and will never go backwards,” Al Gore was quoted as saying, in an article for The Guardian. “I’m extremely optimistic that this will be a critical turning point in our struggle to confront the climate crisis.”

What’s in the Bill?

The focus is on supporting renewable energy projects, investing in US manufacturing of solar panels, wind turbines, batteries, and other technologies.

It will do this largely through tax credits that hope to fuel a boom in investment away from traditional fossil fuel technology and infrastructure.

Electric vehicle rebates will see consumers able to access up to $7,500 for a new EV. The cars must be at least partly manufactured in the US, plus, some smart policy rules put a cap on the price of the cars, as well as a salary hurdle, you must earn less than $150,000.

Emissions reporting was included, but only a tiny $5 million was allocated to standardise corporate and investor climate disclosures.

Greenhouse Gas Reduction Fund will invest $27 billion in emissions reduction projects in low-income and disadvantaged communities.

Renewable Energy Production Tax Credit, will see manufacturers of solar, wind, geothermal and hydrogen receive tax relief.

Nuclear is in there, with funding to keep nuclear power facilities running.

High-emissions industries will be eligible for grants to decarbonise their operations. Agriculture and shipping will be the target.

Carbon capture and storage projects will also be able to access a boosted suite of tax credits.

Clean-tech manufacturing industries will have access to $10 billion in funding for manufacturing and research.

Fees will be levied on methane leaks from oil and gas rigs.

The US Postal Service will see its vast fleet shift to electric vehicles.

While the carried interest loophole was not closed, due to fierce lobbying, there was action on stock buybacks with a 1% excise tax on stock buybacks for any public company buying back shares over $1 million.

Last, but certainly not least, is the major shift in tax rules…

Large companies will now pay a minimum 15% tax on financial statement income. This treatment attempts to manage the tax avoidance schemes of the big tech companies through profit sharing with offshore subsidiaries, as well as deductions.

It’s set to raise a mammoth $313 billion over the next decade.